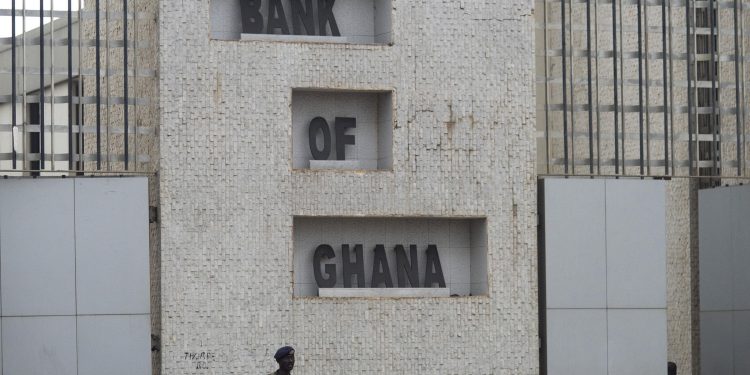

The Bank of Ghana has been challenged to enforce its regulations without fear or favour in 2020 and beyond to ensure the sector continues on its current path of growth.

According to Banking Consultant, Dr. Richmond Atuahene, this will ensure that Ghana’s banking sector becomes one of the best in the West African Sub-region.

The clean up of the country’s financial sector in the last two years saw the collapse of some indigenous banks and many other financial institutions.

But the latest banking sector report from the Bank of Ghana shows the total assets of the entire sector as at October 2019, grew by 13.8 percent to GH¢121.03 billion.

Commenting on the state of the sector going forward, Dr. Atuahene said a key area of focus for the Central bank should be a reduction in the high level of Non-Performing Loans in the country.

“I want to see the banks reduce their NPL’s to meet international levels. This should greatly help in improving their solvency and liquidity. Also we need enforcement and full compliance of the stated regulations such as the corporate governance directives and Basel regulations to help position Ghana’s banking sector as one of the best in the sub-region.”

Basel III is a set of international banking regulations developed by the Bank for International Settlements to promote stability in the international financial system. The Basel III regulations are designed to reduce damage to the economy by banks that take on excess risk.